Customer Acquisition Cost (CAC) is one of the most critical metrics for evaluating the effectiveness of your customer acquisition efforts. It provides insight into how much your business spends to acquire a single customer. By understanding and optimizing CAC, you can ensure that your marketing and sales strategies are cost-effective and sustainable.

Simplified CAC Formula

At its most basic level, CAC is calculated using the following formula:

CAC = (Total Acquisition Costs) / (Number of New Customers Acquired)

- Total Acquisition Costs: This includes all the marketing and sales expenses incurred to attract and convert new customers.

- Number of New Customers Acquired: The total number of new customers your business gained during the period under consideration.

For example, if your company spent $100,000 on customer acquisition in a quarter and acquired 500 customers, your CAC would be:

CAC = $100,000 / 500 = $200 per customer

This simplified formula provides a quick snapshot of your customer acquisition efficiency, but it doesn’t capture the full complexity of what drives your costs.

Advanced and Detailed CAC Calculation

To better understand your customer acquisition costs, you can break down the components that contribute to the overall figure. This detailed approach helps you understand where your money is going and identifies specific areas where you can optimize spending.

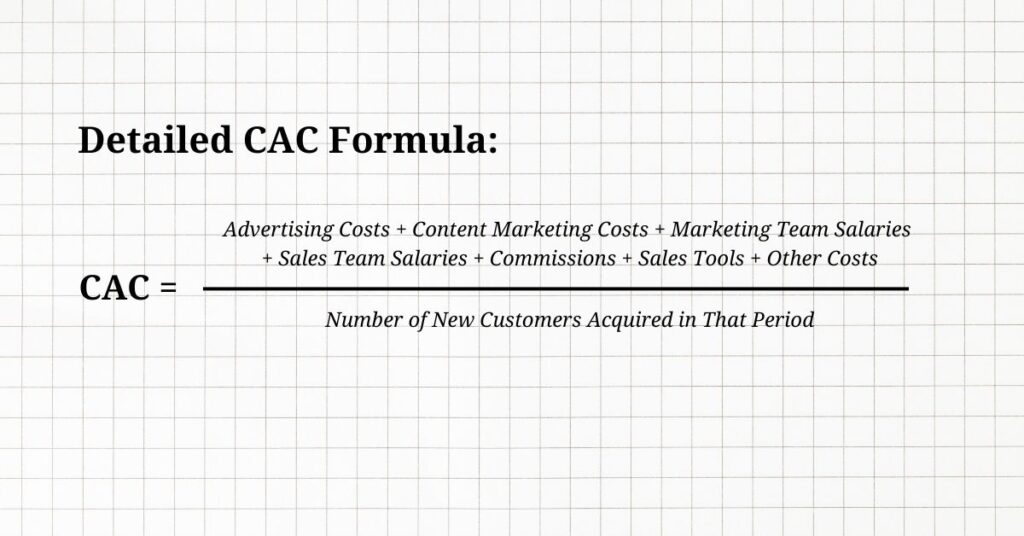

Detailed CAC Formula:

1. Breakdown of Total Acquisition Costs:

a. Marketing Costs:

- Advertising Spend: Includes costs for paid search, social media ads, display ads, etc.

- Content Marketing Costs: Expenses for content creation, SEO, video production, etc.

- Marketing Team Salaries: Salaries for all marketing personnel involved in acquisition efforts.

- Software and Tools: Costs for using CRM systems, email marketing platforms, social media management tools, and analytics tools.

- Creative Production Costs: Graphic design, photography, and video production expenses.

- Events or Sponsorships: Costs associated with participating in or sponsoring trade shows, webinars, or partnerships.

- Public Relations (PR): Costs for press releases, influencer marketing, and other PR activities.

b. Sales Costs:

- Sales Team Salaries and Commissions: Direct salaries and performance-based incentives for salespeople.

- Sales Software Tools: Costs for CRM systems (e.g., Salesforce, CLIQSA), pipeline management tools, and automation software.

- Sales Enablement Content: Creation of case studies, white papers, sales presentations, and other materials that support the sales process.

- Lead Generation Costs: List buying, lead nurturing campaigns, and cold calling expenses.

- Sales Operations Support: Salaries for support staff who assist with the sales process.

c. Overhead and Miscellaneous Costs:

- Training Costs: Expenses for training sales and marketing teams.

- Office Space and Utilities: Proportional costs for office space, utilities, and other operational expenses for sales and marketing departments.

- Administrative Expenses: Any other costs that indirectly support sales and marketing activities.

Example of an Extended CAC Calculation:

Let’s break down a real-world example to illustrate the detailed CAC calculation:

- Advertising Costs: $100,000 on online ads.

- Content Marketing Costs: $50,000 for content creation and SEO.

- Marketing Team Salaries: $150,000 for your marketing team.

- Sales Team Salaries and Commissions: $100,000 for sales personnel.

- Sales Tools: $20,000 on CRM systems and pipeline management tools.

- Overhead Costs: $10,000 for office space, training, and other miscellaneous expenses.

Total Acquisition Costs = $100,000 + $50,000 + $150,000 + $100,000 + $20,000 + $10,000 = $430,000

If you acquired 200 customers in that quarter, your detailed CAC would be:

CAC=$430,000200=$2,150 per customer\text{CAC} = \frac{\$430,000}{200} = \$2,150 \text{ per customer}CAC=200$430,000=$2,150 per customer

This detailed calculation gives you a more nuanced view of what’s driving your customer acquisition costs. Understanding the individual components allows you to pinpoint areas where you might be overspending or identify opportunities for cost optimization.

Additional Considerations for CAC Analysis

- Time Period: Adjust the time period for your CAC calculations (monthly, quarterly, yearly) to align with your business cycle and marketing campaigns.

- Channel-Specific CAC: Calculating CAC by acquisition channel (e.g., paid ads, organic search, referrals) can help you identify which channels are most cost-effective and where to focus your resources.

- Customer Lifetime Value (CLV) to CAC Ratio: To gauge the efficiency of your acquisition efforts, compare your CAC to the Customer Lifetime Value (CLV). A CLV/CAC ratio of 3:1 is often considered healthy, meaning you generate three times the value for every dollar spent on acquiring a customer.

By using both the simplified and detailed CAC formulas, businesses can better understand their acquisition costs and make more informed decisions about where to allocate resources. This comprehensive approach to CAC analysis helps optimize customer acquisition strategies, ultimately driving more sustainable growth.